What's New for 2020?

Open enrollment season is here! It will begin on February 10, 2020 and end February 21, 2020 at 5:00 p.m. EST. We are pleased to invite all benefits eligible employees to swim through the enrollment process, make changes or confirm their current benefits for the upcoming plan year April 1, 2020 - March 31, 2021.

DOWNLOAD THE 2020 OPEN ENROLLMENT PRESENTATION

How to Enroll

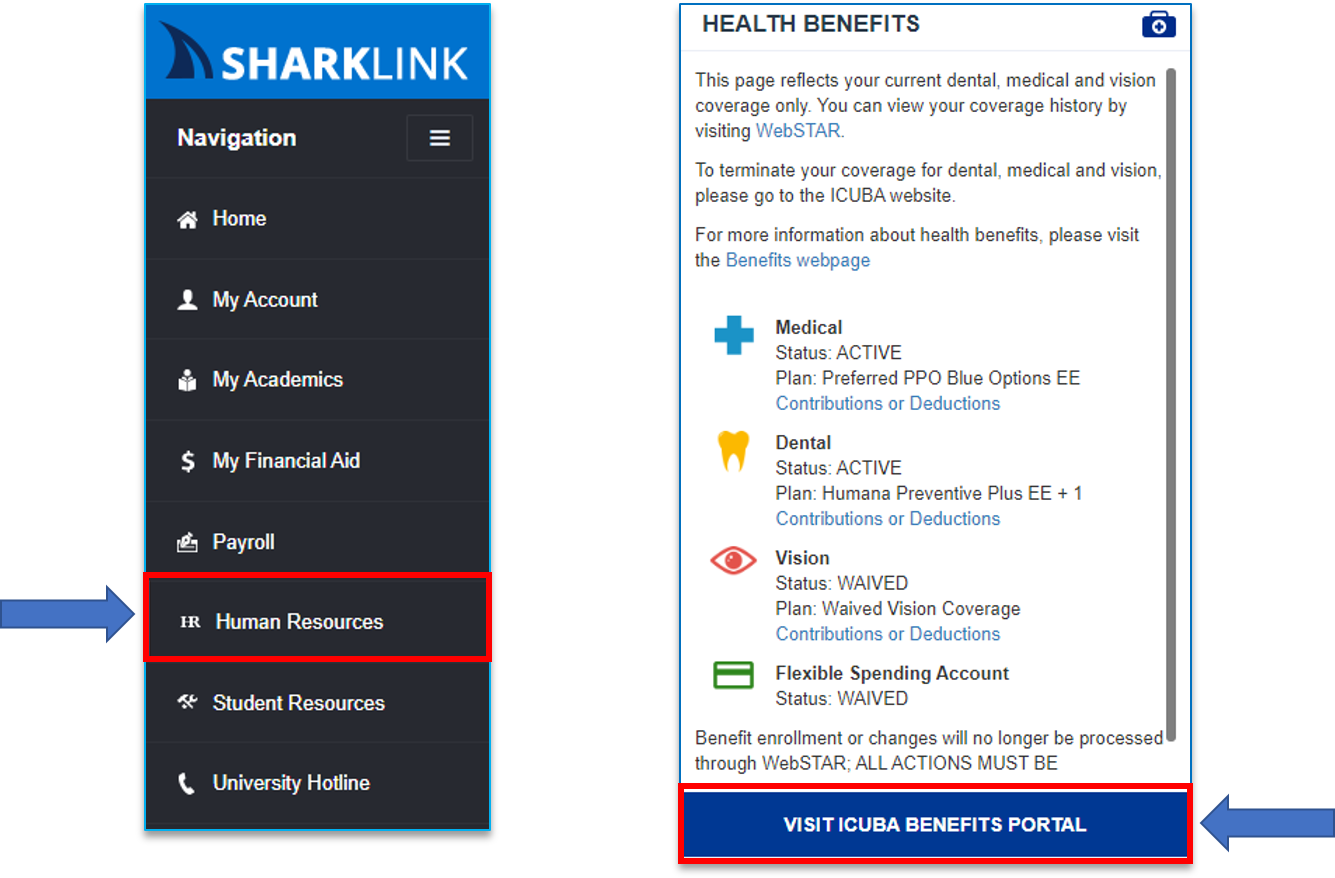

Single Sign-on From SharkLink Into The ICUBA Enrollment Portal will be established for open enrollment! Are you tired of trying to remember your ICUBA enrollment portal login every year? Now you can forget it forever! Use your NSU credentials and the single sign-on from Sharklink, go directly into the ICUBA enrollment portal, elect your benefit plans, access your HRA & FSA account details, find claim and contact information, and print ID cards. How easy is that? Find the new ICUBA SSO in Sharklink!

Health Care Options

Separating from NSU

- Most of your benefits will end at midnight on the last day of the month during which the termination occurs. You will be billed for the full month's premiums. Income Protection coverage (Basic and Voluntary Life/AD&D, Disability) ends on the date of termination.

- You will be e-mailed the Triple-s disenrollment form to be signed and e-mailed back.

- Notification for eligibility to continue coverage under the provisions of the Consolidated Omnibus Budget Reconciliation Act (COBRA) will be sent to you via US Mail within 14 days of your last date of employment.

2020 Dental Premiums

Humana Dental DHMO (CS250) |

||

| Tier | Monthly | Bi-weekly |

| Employee Only | $11.83 | $5.92 |

| Employee + One Dependent | $23.73 | $11.87 |

| Employee + More than one dependent | $36.85 | $18.43 |

Humana Dental Preventive Plus PPO |

||

| Tier | Monthly | Bi-weekly |

| Employee Only | $19.67 | $9.83 |

| Employee + One Dependent | $45.72 | $22.86 |

| Employee + More than one dependent | $75.69 | $37.84 |

Humana Dental PPO High Coverage |

||

| Tier | Monthly | Bi-weekly |

| Employee Only | $40.81 | $20.41 |

| Employee + One Dependent | $81.29 | $40.65 |

| Employee + More than one dependent | $136.71 | $68.36 |

2020 Vision Premiums

Eyemed Vision Base Plan |

||

| Tier | Monthly | Bi-weekly |

| Employee Only | $3.91 | $1.96 |

| Employee + Family | $10.02 | $5.01 |

Eyemed Vision Enhanced (Buy Up) Plan |

||

| Tier | Monthly | Bi-weekly |

| Employee Only | $4.83 | $2.42 |

| Employee + Family | $12.36 | $6.18 |

2022 GAP Premiums

APL GAP Insurance for Premier and Preferred PPO Plans |

||

| Tier | Monthly | Bi-weekly |

| Employee Only | $33.71 | $16.90 |

| Employee + Spouse | $68.81 | $34.41 |

| Employee + Child(ren) | $58.97 | $29.46 |

| Employee + Family | $86.08 | $43.04 |

APL GAP Insurance for $4K/$8K PPO Plan |

||

| Tier | Monthly | Bi-weekly |

| Employee Only | $43.02 | $21.51 |

| Employee + Spouse | $87.78 | $43.89 |

| Employee + Child(ren) | $75.26 | $37.63 |

| Employee + Family | $109.84 | $54.92 |

New Group Aflac Plans and Enhanced Voluntary Life Insurance

Aflac Group Plans

Accident Insurance

The Voluntary Accident Plan is designed to help cover the expenses associated with an accidental injury such as a medical plan deductible. Accident pays direct cash benefits for emergency treatment, hospitalizations, specific injury treatments, diagnostic exams and accidental death.

Coverage |

Monthly Rates |

Employee |

$10.35 |

Employee and Spouse |

$17.76 |

Employee and Child(ren) |

$20.43 |

Family |

$27.84 |

Download Aflac Accident Insurance Summary

Critical Illness Insurance

The Voluntary Critical Illness coverage is designed to pay cash in the event you or a covered family member is diagnosed with a critical illness such as cancer, heart attack, stroke, kidney failure, benign brain tumor, loss of hearing or sight due to a severe medical condition or Alzheimer's. Critical illness helps protect your income and personal assets when out of pocket expenses increase as a result of a specified critical illness.

BENEFIT HIGHLIGHTS |

| $10,000 benefit for employees on a guarantee issue basis (no health questions) |

| No pre-existing condition limitation** |

| The ability to collect 100% of enrolled benefit amount for different diagnosed illnesses and recurrence of the same condition |

| Pays a lump sum benefit tax free regardless of any other insurance you may have |

| Eligibility is employee and spouse and children up to the age of 26 |

** Children are automatically covered at 50%

**Benefit restrictions will apply for cancer treatments or diagnosis in the prior 12 months.

** Rates will vary depending on your selected coverage and will be available during your enrollment process.

DOWNLOAD Aflac CRITICAL ILLNESS SUMMARY

Hospital Indemnity Insurance

An unexpected or even planned stay in the hospital can be expensive as you meet your deductible and out-of-pocket obligations under the medical plan. The Hospital Indemnity plan is designed to provide financial protection by paying you a direct benefit to meet out-of-pocket expenses and extra bills that may occur. Lump sum benefits are paid directly to you based on the type of facility and number of days of confinement.

- Guarantee issue ( no medical questions)

- No pre-existing condition limitation

- Portability is included

Coverage / Monthly Rates |

MID |

LOW |

Employee |

$12.72 | $7.32 |

Employee and Spouse |

$25.64 | $15.74 |

Employee and Child(ren) |

$20.04 |

$12.44 |

Family |

$32.96 | $20.86 |

Employee Voluntary Life Insurance with Lincoln Financial

You may purchase this coverage in increments of $10,000 up to a maximum of $500,000. Evidence of Insurability (EOI) is required for amounts above $300,000 and must be approved by Lincoln Financial Group. Age reductions apply at ages 65 and 70.

Dependent Voluntary Life Insurance

You may purchase Dependent Life Insurance for: Spouse or Domestic Partner, and children. The spouse benefit is $30,000 and the Child coverage is equal to $10,000 (for ages 14 days to 6 months, the coverage is $500). Age reductions apply at age 65 and 70.

** Rates will vary depending on coverage election and will be available during your enrollment process through the ICUBA Enrollment Portal

Optional Benefits

LegalShield was founded in 1972, and currently provides services to more than 3.5 million individuals throughout the United States and Canada. Enrolled members can talk to a lawyer on any personal legal matter, no matter how big or small, all without worrying about high hourly costs.

LegalShield has provided identity theft protection since 2003 with Roll Advisory Solutions, the world’s leading company in ID Theft consulting and restoration. With IDShield provided by LegalShield covered employees can take advantage of their expertise in safeguarding and restoring your identity.

Plan |

Individual Price (Monthly) |

Family Price (Monthly) |

LegalShield |

$15.95 | $15.95 |

IDShield |

$8.45 | $15.95 |

Combined |

$24.40 | $28.90 |

2022 Pet Assure Premiums

Pet Discount Program - Pet Benefit Solutions |

||

| Tier | Monthly | Bi-weekly |

| Single Pet Household | $11.76 | $5.88 |

| Multiple Pet Household | $18.50 | $9.25 |