Apply for Aid - Getting Started

Going to college can be both exciting and financially challenging. The Office of Financial Aid is dedicated to helping you navigate the steps in the student financial aid process.

Step 1: Create an FSA Account (FSA ID)

Before you can do anything, you will need a StudentAid.Gov account! Your StudentAid.Gov account username and password will be used to access federal student aid websites. If you already have an FSA ID, you are good to go.

IMPORTANT:

- Students and their contributors will each need to have their own StudentAid.gov account username and password and unique phone number or email.

- It can take several days for the account to be created and verified. Do this early!

Step 2: Complete the FAFSA

Complete the Free Application for Federal Student Aid (FAFSA) online annually as early as possible. The NSU Federal School Code is 001509.

Complete the FAFSA 2024-25 FAFSA FAQs

A Special Note About Summer Aid (Traditional Undergraduate Day Students):

Financial aid for undergraduate students is typically awarded for the fall and winter semesters. If you would like to be offered summer financial aid, submit a request for summer aid each year. This is not a requirement for undergraduate students in the Ron and Kathy Assaf College of Nursing and the Dr. Pallavi Patel College of Health Care Sciences, as they are automatically offered summer aid.

Apply for Summer Aid (Undergraduates only)

Step 3: Identify and Apply For Scholarships

Institutional and external scholarship opportunities are available to assist you in meeting your educational goals. The best resource for up-to-date information is the NSU scholarship website. You will find information on how to apply, as well as resources to help you identify scholarships. Commit to continuously identifying and applying for scholarships. This type of financial aid does not have to be repaid.

TIP: Be sure to complete the Scholarship Profile each year! This application allows you to apply for multiple institutional scholarships with one application.

Step 4: Plan for Housing and Meal Expenses

Your financial aid budget includes a housing and meal component. Be sure to budget for these costs, especially if you intend to live on campus. For information regarding housing, visit Residential Life & Housing.

Step 5: Complete NSU State Aid Application (Florida Residents)

You only need to complete the NSU State Aid Application if you qualify as a Florida resident and are an undergraduate student seeking your first bachelor's degree, or if you are a graduate student entering your first semester with possible Florida Bright Futures credits available.

Exception: Students who have received EASE, FSAG and/or Florida Bright Futures Scholarship funding in the prior year (i.e., received aid in the 2023-2024 academic year at NSU and are applying for 2024-2025), and did not have a break in enrollment for more than 12 months do not have to complete the NSU State Aid Application.

Complete THE NSU State Aid Application

Step 6: Review your FAFSA Submission Summary

The Department of Education will issue a FAFSA Submission Summary (previously referred to as Student Aid Report) once your FAFSA has been processed by the Department. The summary will include your Student Aid Index (SAI) which is used to determine your eligibility for federal aid.

In the past, schools would receive students' FAFSAs within 3-5 business days of filing. For the 2024-25 aid year, FAFSA files are expected to be released to schools beginning in late March 2024. The NSU Office of Financial Aid will send an email to your NSU email once your 2024-25 FAFSA has been received by NSU.

Step 7: Submit Additional Documentation

Some students are required to submit additional documents to complete the financial aid process prior to being awarded. Check your financial aid status in SharkLink regularly to view any outstanding requirements.

For step-by-step instructions on how to view your outstanding requirements in SharkLink, visit the Your Online Financial Aid Account page.

VIEW YOUR FINANCIAL AID STATUS & REquirements

Step 8: Register for Classes

Familiarize yourself with enrollment requirements defined by your program and the financial aid program through which you are receiving aid. Students awarded Federal Direct Loans must enrolled at least half time in courses that are required for degree or certificate completion. Half-time enrollment is defined as 6 credits per semester for undergraduate students. For graduate and first-professional students, half-time status varies by program. Register early for timely disbursement of your financial aid.

Learn How to Register for CLASSES

2024-25 FAFSA Changes & Alerts

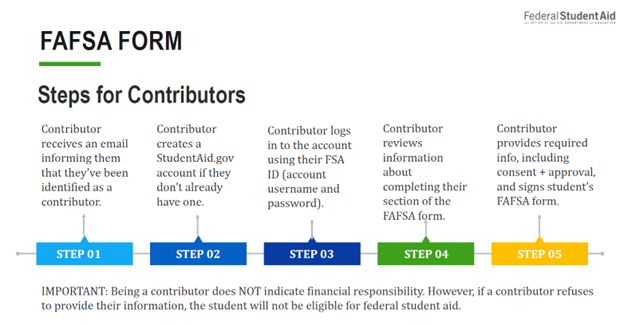

One of the new terms on the 2024-25 FAFSA is the "contributor." Student answers on the FAFSA determine who else will be a contributor. Students will need the contributor's name, date of birth, Social Security Number, and email address to invite the contributor to complete the FAFSA.

What/who is a contributor?

- Anyone required to provide information, a signature, or consent and approval to have federal tax information transferred directly into the FAFSA form is a contributor.

- Contributors are not financially responsible for the student's education.

- Contributors may include the student, the student's spouse, and the student's parent (biological, adoptive, or stepparent).

- Contributors are determined by your dependency status, tax filing status, and marital status.

Who are not contributors?

- grandparents

- foster parents

- legal guardians

- siblings

- aunts and uncles

Additional information on contributors:

- If you are a dependent student, you must indicate your parents or stepparents as contributors on the FAFSA.

- If your parents are married and filed joint 2022 tax returns, only one parent needs to complete the FAFSA as a contributor.

- If your parents are married and filed separate 2022 tax returns, both parents need to complete the FAFSA as contributors.

- If your parents are divorced, separated, or never married, the parent who provides the most financial support should complete the FAFSA as a contributor.

- If you are married, you must indicate your spouse as a contributor on the FAFSA.

What do contributors have to do?

- Have a StudentAid.gov account

- Provide information required on the student's FAFSA form

- Provide consent to have their Federal Tax Information (FTI) transferred from the IRS and sent to the colleges listed on the FAFSA.

The FAFSA is considered complete and submitted on the date that all contributors (student, spouse, parent as applicable) complete and submit their sections, not when the student starts the FAFSA and not on the date the student completes/submits their own section.

If a contributor does not submit his/her section within 45 days, the FAFSA will be deleted, and the student will have to start the process over.

Students and parents of dependent students, or spouses of independent students, must provide consent and approval for their federal tax information to be transferred directly into the FAFSA to be shared with the schools listed on the FAFSA.

If any contributor refuses to provide consent and approval, the student will not be eligible to receive federal student aid.

If you are experiencing a particular challenge in submitting your 2024-25 FAFSA you may not be alone. The Department of Education is maintaining a 2024-25 FAFSA Issue Alerts webpage so that filers can learn about the status of various issues and their resolution during the soft launch phase.